CBAM for Iron and Steel Imports

Product Carbon Footprint, Verification, Certification, Reporting and Advisory Services

- Home /

- Services /

- Climate Change /

- CBAM for Iron and Steel Imports

CBAM Business Group

Carbon Border Adjustment Mechanism (CBAM) for Iron and Steel

The Carbon Border Adjustment Mechanism (CBAM) regulation is an import tariff with the transitional reporting phase beginning October 1, 2023 through December 31, 2025, that applies to Iron and Steel products being imported into the European Union. CBAM could lead to logistical and reporting challenges as well as increased costs for imported steel products that come from regions with less stringent carbon pricing or emissions standards. A key goal of CBAM for the Iron and Steel industry is for manufactures to adopt and report cleaner technologies and practices, contributing to global efforts to combat climate change. SCS Global Services provides product carbon footprint services to assess embedded emissions in compliance with CBAM regulations.

The product carbon footprint for iron and steel refers to the total greenhouse gas emissions associated with the raw material extraction and production of iron and steel products. This carbon footprint is typically expressed in terms of CO2 equivalent emissions and is an important metric for assessing the environmental impact of materials.

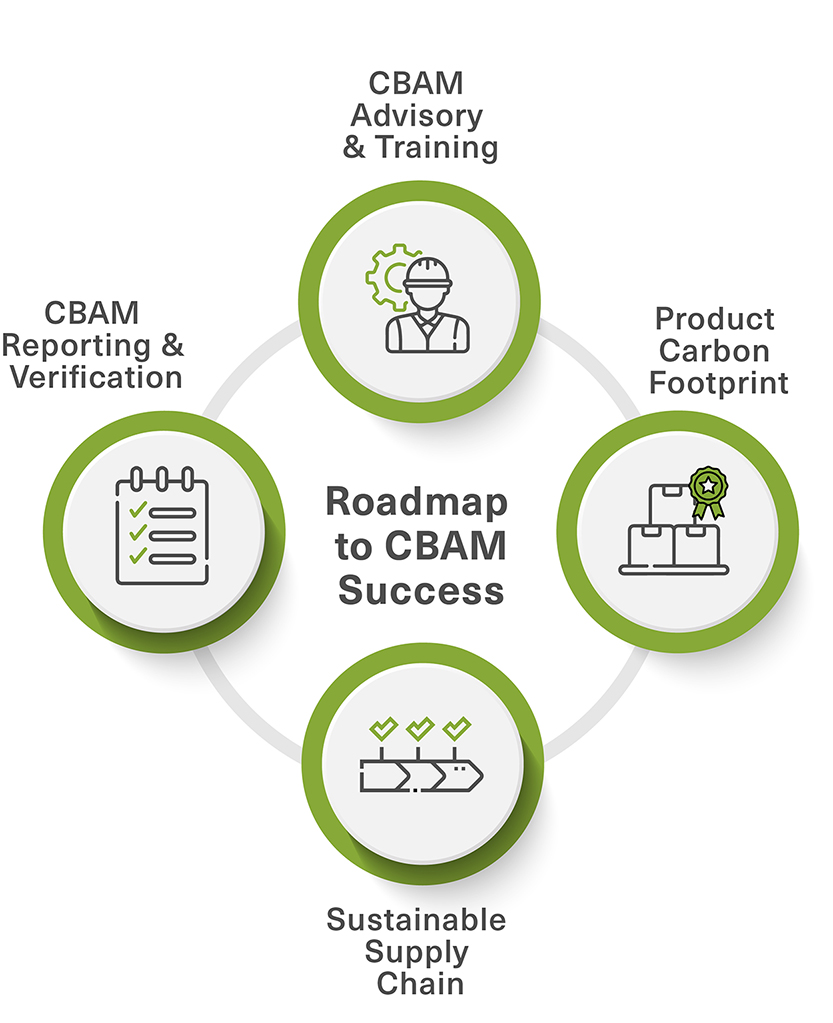

Your CBAM Solutions with SCS Global Services

As an experienced LCA provider, SCS brings 30 years of technical expertise to help you meet CBAM requirements and compliance, including reporting, data verification and report assurance. Our process starts with defining the scope, boundaries, and stages of your iron and steel products' life cycle, gathering data on energy and materials used in each stage, and choosing appropriate LCA methodology to assess carbon emissions. Our experts will calculate your emissions, accounting for cleaner and more efficient energy sources like renewable energy or natural gas. Your data will then be normalized to a common declared unit, such as per tonne of steel produced.

This advanced accounting process ensures that your outcomes are authentic, unbiased, and accurate to meet CBAM reporting requirements and to cover embedded emissions. In 2026, iron and steel importers will be required to also purchase and provide CBAM certificates to offset products’ excess embedded emissions, at prices set by the EU Emissions trading System (EU ETS) to ensure fair trade within the EU and to mitigate climate change. SCS also offers importers and installation operators one-off CBAM Carbon Footprint reports that can be used to automatically populate into the CBAM templates. Whatever your CBAM Needs are, SCS can assist you.

- CBAM One-off Reports

- CBAM Reporting Tool

- Reporting and Verification

CBAM One-off Reports For Importers

SCS LCA practitioners follow CBAM regulatory requirements to gather data from iron and steel producing installations to create a Carbon footprint report. The information from this report can be used to populate the CBAM Reports that must be filed in the EU.

Deliverables:

- Carbon Footprint Report containing tonnes CO2 / tonnes product and other information.

- Completed CBAM communication template for installation(s).

Add-On Services

- ISO 14067 Product Carbon Footprint & certificate for marketing purposes.

- CBAM report submission or submission assistance.

- SCS assurance of data entered to minimize risk of EU audit.

- Cost savings for additional products from other CBAM categories

- Cost savings for additional installations included in the scope

CBAM One-off Reports for Installations

SCS LCA practitioners assist installations with populating the CBAM communication template for installations, and generating CBAM carbon footprints, to be provided to Importers.T his includes a check of data quality and completeness, to streamline the data submission process.;

Deliverables

- Carbon Footprint Report containing tonnes CO2 / tonnes product and other information.

- Completed CBAM communication template for installations, including embedded direct and indirect emissions of products.

Add-On Services

- ISO 14067 Product Carbon Footprints & certificates for marketing purposes

- Importer data Submission assistance

- Cost savings for additional products

- Cost savings for additional installation included in the scope

CBAM Reporting Tool for Importers

Importers will gain access to the SCS Product Carbon Footprint Tool, a SaaS digital platform that gathers data from installations, calculates results, and generates reports.

Deliverables

- Carbon Footprint Report containing tonnes CO2 / tonnes product and other information

- CBAM Reports automatically generated based on inputs about shipment size, import location, and shipment weight.

Add-On Services

- Consulting support for data gathering from installations

- ISO 14067 Product Carbon Footprints & certificates for marketing purposes

- CBAM report submission and/or assistance

- SCS assurance of data entered to minimize risk of EU audit

- Cost Savings for additional product families

CBAM Reporting Tool for Installations

Installation owners gains access to the SCS Product Carbon Footprint Tool, a SaaS digital platform which receives direct data entry, auto-populates the CBAM communication template for installations, and generates CBAM carbon footprints, to be provided to Importers.

Deliverables

- Carbon Footprint Reports containing tonnes CO2 / tonnes product and other information.

- Completed CBAM communication template for installations, including embedded direct and indirect emissions of products

Add-On Services

- Consulting support

- ISO 14067 Product Carbon Footprints & certificates for marketing purposes

- Assistance in submitting this data to Importers

- SCS assurance of data entry, to streamline the data submission process

- Incremental fees per additional product family

- Incremental fees per additional installation included in the scope

Reporting and Verification services will soon be available from SCS as the CBAM regulations and reporting infrastructure, including the CBAM Transitional Registry, scheduled to be part of the CBAM Competent Authorities Traders Portal, are further developed by the EU Commission.

While the first CBAM report will be due no later than January 31, 2024 for the preceding quarter, as of this writing, and according to the CBAM Regulation, the following items will need to be reported:

- The total quantity of each type of product, identified by CN/tariff code, expressed in tonnes

- Country of origin

- The installation where the product was produced (and specifically for steel goods, where known, the identification number for the steel mill where the batch of raw materials originated)

- The production route used for the manufacturing of the product, which reflects the technological option and information on specific parameters qualifying the route chosen and descriptive parameters that affect the embedded emissions of the goods

- Total embedded emissions in tonnes of CO2 emitted for the goods, which would be calculated according to the method listed in Annex IV of the CBAM Regulation, as further expanded upon in the implementing regulation

- The direct embedded emissions following the methods detailed in Annex III of the draft implementing

- The embedded indirect emissions following the methods detailed in Annex III as well as the electricity consumption and the corresponding emissions factor, and

- Carbon price paid abroad

In order to ensure the efficient implementation of reporting obligations, an electronic database will be established by the EU Commission to collect the information reported during the transitional period. This Registry is scheduled to be available by October 1, 2023.

Verification of emissions data for products subject to the CBAM Regulation will not be required until the full implementation of the regulation starts in 2026. Further details will be forthcoming.