Meeting the New Carbon Border Adjustment Mechanism (CBAM) Regulation Requirements with Product Carbon Footprints

As the United Nations’ latest Emissions Gap report reveals that humanity’s burning of fossil fuels could result in a swift blowing past recommended global average temperature limits set forth in the Paris Agreement, the European Union (EU) is advancing a policy that is underlining and supporting the need for serious and rapid climate action.

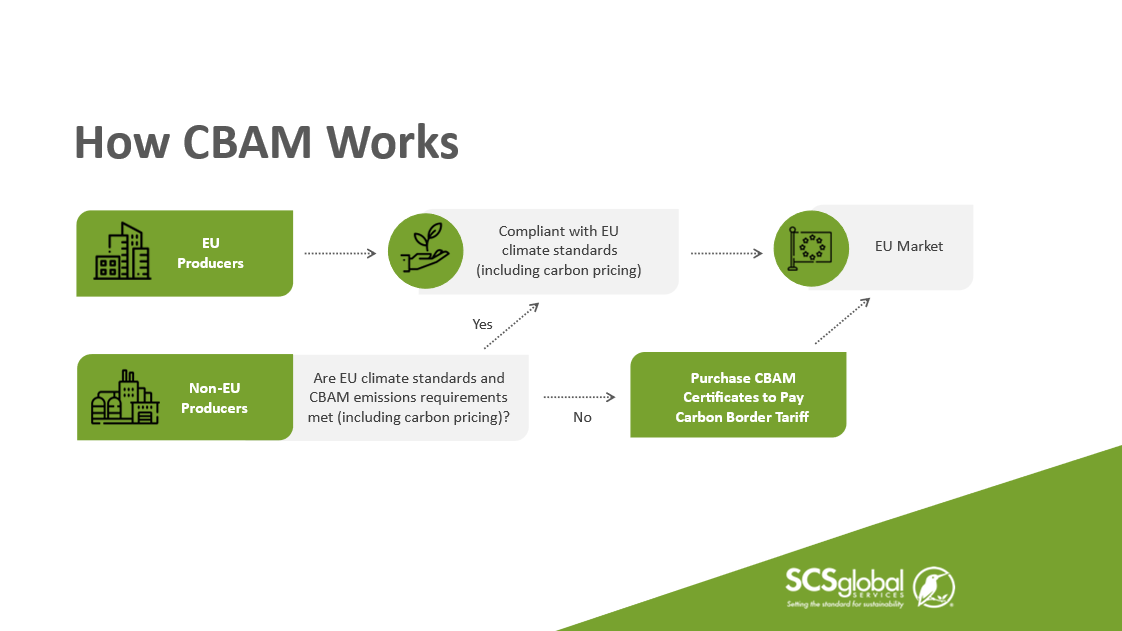

Through the EU Carbon Border Adjustment Mechanism (CBAM) — originally introduced in 2020 as part of The European Green Deal to mobilize the ambitious goal of Europe becoming the first climate-neutral continent by 2050 — the EU aims to confront the realities of carbon leakage, a byproduct of industrial manufacturing that occurs when products or parts of products made in countries with less strict emissions regulations are imported to countries with more stringent climate laws.

For all companies importing goods in the iron and steel, aluminum, electricity, cement, hydrogen, and fertilizer sectors, the first quarterly reports during the current transitional phase were to be submitted by January 31, 2024 to the CBAM Transitional Registry. But as of January 2026, when the new CBAM regulations take full effect with tariffs administered, all importers will be required to submit reports based on the actual embedded emissions calculated by their suppliers. For many manufacturers who have never completed a carbon footprint, this can pose significant challenges.

If your company is a supplier to the EU and has questions about how to calculate your products’ carbon footprint or your company is an importer and has questions about how to report emissions upon importation to EU member states under the new CBAM regulations, SCS has established a new CBAM Support Services program to help companies achieve compliance with the regulation.

Ensuring CBAM compliance with Product Carbon Footprints

Because so many SCS customers operate within industries that will be most impacted by the new CBAM rules, SCS has developed an advanced Product Carbon Footprint tool specifically designed to help customers not only calculate the direct and indirect emissions of their products, but also to take full advantage of the EU’s transitional period, October 2023 — end of December 2025, as the EU Commission itself continues to provide updates and guidance on reporting requirements and acceptable baseline emissions reporting data for each sector.

By taking action now and preparing CBAM reports based on embedded emissions calculated from actual supplier data as opposed to the default values for embedded emissions of CBAM goods currently accepted in this transitional phase, customers functioning within affected industries will have the most accurate reporting data on their goods and will be able to ensure the accuracy of their carbon emissions tracking and reporting well in advance of the January 2026 deadline.

How are CBAM Carbon Footprints Different?

Global companies producing goods in the iron and steel, aluminum, electricity, cement, hydrogen, and fertilizer sectors outside the European Union will be required to provide a full accounting of their products’ indirect and direct greenhouse gas emissions upon importation to European Union member states.

For companies familiar with tracking and reporting carbon footprints for a range of products, the requirements of CBAM reporting vary from existing methodologies required by other commonly used standards such as PAS 2050, WRI/WBCSD GHG Protocol and the ISO/TS 14067 accounting methodology.

The biggest difference between existing methodologies for calculating product carbon footprints and the new CBAM regulations involves which of the manufacturing precursors earlier in the supply chain must be tracked, calculated, and reported to EU authorities.

CBAM categorizes emissions into direct and indirect emissions. Direct emissions include those generated by fossil fuel combustion, industrial processes, heating, and cooling that occur throughout the production process. Most notably, the new CBAM regulation requires calculating indirect emissions from generating the electricity used in production of all relevant precursors. Reporting indirect emissions earlier in the supply chain will be of vital importance to ensuring a seamless transition into this new era of more ambitious climate initiatives emerging from the EU.

Steps in the process of getting information ready for CBAM

At a high-level, the first step is all about gathering the best possible data. For example, an aluminum extrusion plant will be charged with calculating the emissions from all the fuels used on site at any point in the extrusion process as well as the electricity consumed at the extrusion facility. They must also account for the direct and indirect emissions embedded in the aluminum inputs to their process, using data provided by the supplier or default values. Aluminum extruders located outside of the EU that have contracts with an EU importer will be required to submit their embedded emissions data — that is, tonnes of carbon dioxide equivalent per tonne of product — to the importer to facilitate the CBAM reporting process.

Importers will need to calculate total carbon dioxide equivalent emissions embedded in their imports, as in the total tonnes of the product shipment multiplied by the embedded emissions per tonne of each good. Tariffs will be calculated based on this number for all in-scope products imported to the EU beginning January 2026.

While the importers’ calculations are relatively simple, the data gathering process at installations can take a lot longer than companies might think — even those that are already efficient and actively gathering data.

Once they have calculated both direct and indirect emissions associated with their imported goods, importers can choose to use the portal provided by the CBAM commission or an external tool to prepare their CBAM report.

Generating the CBAM-compliant report

SCS has a readily deployable CBAM reporting tool that can generate CBAM-compliant communication templates based on data provided describing the manufacturing process and CBAM reports based on data entered by the importer for each sector covered in the CBAM regulation.

The reporting tool also provides access to a curated list of datasets that are relevant to a manufacturer’s production process and precursor materials. Providing the necessary datasets will ensure accurate calculations and reporting.

Perhaps most importantly, SCS’ reporting tool offers customers the chance to confirm their data and calculations through third-party verification — a CBAM requirement starting in 2026 — so customers can trust that their reports will satisfy the next phase of CBAM implementation.

To learn more, listen to our latest CBAM webinar where we dig a bit deeper into our Carbon Border Adjustment Mechanism Support Service and help companies get ready to track, calculate, and report greenhouse gas emissions across the full life cycle of their products to ensure compliance with the new CBAM regulations.

To schedule a meeting to discuss your organization’s CBAM needs, please contact:

North America

Oren Jaffe

Director of Sales, ECS

+1-510-882-0951

India

Bobby Matthew

Director of Business Development, India & Middle East

Europe

Gustavo Bacchi

Director, Business Development, Europe