CDP Reporting Services That Deliver Results

Turn CDP into a strategic advantage. SCS Consulting helps you improve your CDP score, streamline reporting, and align with emerging climate risk regulations — without the stress.

Boost Your Score — and Reduce the Stress

For companies reporting to CDP, disclosure season can be time-consuming and overwhelming. Our CDP experts help you strengthen and streamline your reporting and capture higher scores while unlocking strategic value for your company’s sustainability journey. At SCS Consulting, we help you transform CDP from a box-checking exercise into a powerful tool for ESG communication, performance improvement, and ESG strategy.

We help clients boost their CDP scores while minimizing the internal burden through a proven, efficient process. With deep experience across CDP’s climate, water, and forests topics, we understand the nuances of scoring and how to position your data and narrative for maximum impact.

But we don’t stop at CDP Report submission. Our clients gain insight into the critical, integrative actions that could benefit their sustainability strategy. We align your CDP disclosure and scoring goals to the global ESG frameworks used by your company and create short-, medium-, and long-term performance roadmaps towards CDP leadership level and robust integrated reporting.

Key Value Drivers

- Score-focused strategy: Every edit, data point, and narrative is built with CDP’s scoring methodology in mind.

- Efficient, guided process: No more ‘winging it’ processes nor reading through hundreds of CDP guidance documents up against the reporting deadline. We manage it for you.

- Better internal alignment: We make it easier to connect sustainability, compliance, and risk teams.

- Cross-framework insight: CDP support that also helps you understand the throughlines and prepare for IFRS S2, CSRD, and TCFD.

What’s Changing in CDP and Why Strong Scores Matter More Than Ever

The CDP landscape is shifting fast. In 2024, CDP introduced one of its biggest overhauls to date, and many companies were caught off guard. What used to be a familiar process has become more complex, more technical, and more strategically important.

Here’s what’s changed and why it matters:

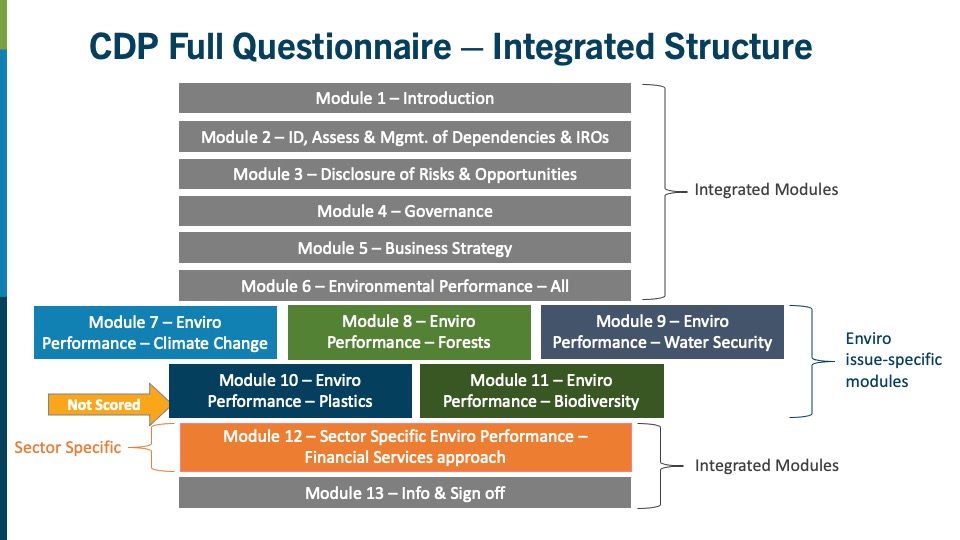

- One integrated questionnaire now replaces separate Climate, Water, and Forests disclosures – increasing the breadth and depth of data you need to report.

- New questions and revised scoring methodologies mean companies must rethink how they approach their responses — not just recycle last year’s. The changes require a deeper technical understanding than before.

- Closer alignment with ESG frameworks like TCFD, ISSB/IFRS S2, and CSRD adds pressure to ensure your CDP disclosures are consistent, strategic, and regulator ready. It also creates opportunities that we leverage for you.

- Many companies saw unexpected score drops in 2024 even with strong ESG programs and due to a mismatch between past strategies and the new structure.

- Greater visibility with investors, customers, and regulators occurs each year with increased adoption as the world’s largest environmental reporting framework.

Your score is no longer just a disclosure metric – it’s a reflection of your climate readiness, risk management, and ESG credibility. We help you navigate these changes with clarity and confidence, so you stay ahead, not behind.

CDP and Climate Risk Disclosure Regulations

CDP is not just about voluntary transparency – it’s becoming a vital part of regulatory readiness. California’s SB 261 and SB 253 and the global IFRS S2 standard are bringing new climate-related disclosure requirements. Luckily, CDP’s Climate questionnaire is already structured around the key pillars of TCFD, which form the basis of both new rules.

We help you prepare your CDP submission in a way that strengthens your compliance posture for SB 261 and IFRS S2 – especially around governance, risk management, scenario analysis, and emissions metrics. Since companies are expected to publish reports by Jan 1, 2026, now is the time to begin leveraging expertise towards both CDP and Climate Risk Reporting.